Request To Waive Penalty | Online by authorized tax professional working on behalf of client, 3. This is to request you to waive the penalty fee and interest assessed on the below referenced account for the month of december 2013. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty). I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. If an unpaid balance remains on your account, interest will continue to.

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not intentional or due to neglect, you have the right to request a penalty waiver. To request a waiver, you should do the following List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. I recognize that a mistake was made by me and would rectify the problem. The penalties are equal to five percent of the balance owed plus and an additional percent for each month you are late.

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not intentional or due to neglect, you have the right to request a penalty waiver. If you have been charged a penalty but believe you have reasonable cause (e.g. All other requests now being assigned to an officer were received in december 2019. It's true that i paid {number} days late, but there were extenuating circumstances. The irs today issued a release announcing that it is automatically waiving the estimated tax penalty for eligible individual taxpayers (estimated to be. You will have an opportunity to upload your supporting documents during the docusign process at the end of the application. Online by authorized tax professional working on behalf of client, 3. Waiver of late tax payment / filing penalty. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. Penalties can be waived because of Penalties may be waived upon payment of the registration fees due when a transferee (including a dealer) applies for transfer and it is determined that the registration issued by dmv that matches the year for which the transferee is requesting a waiver of fees and penalties (cvc §9562(c)). Waiver of penalty letter example. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount.

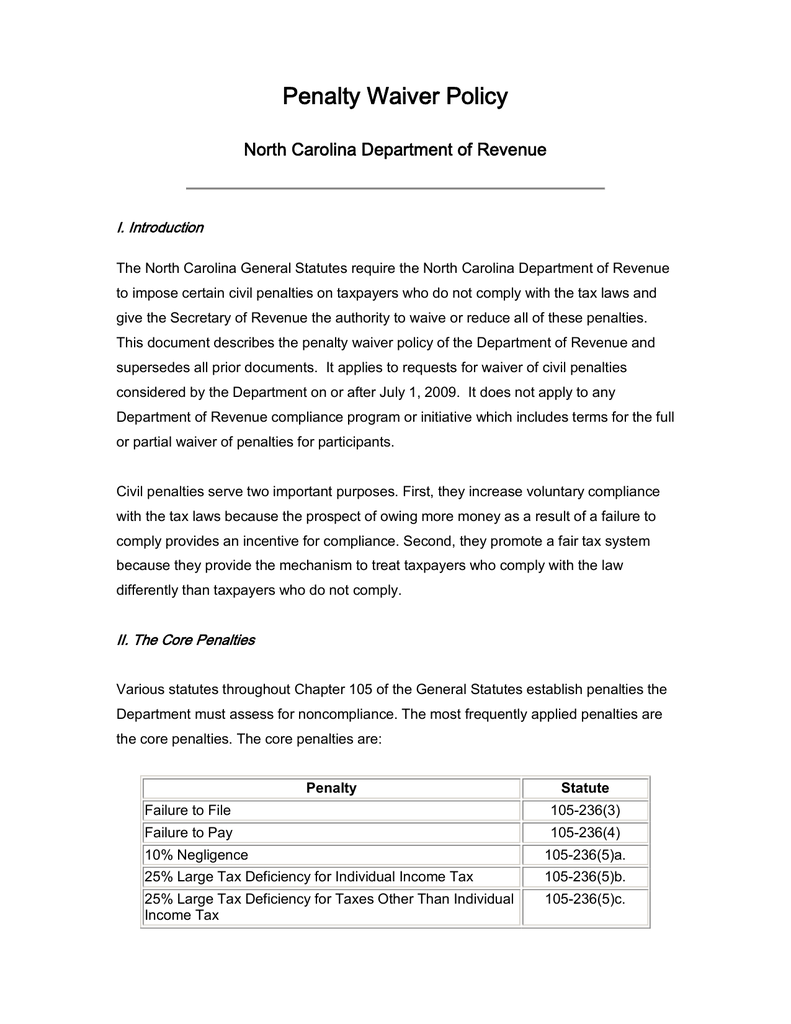

Section 11 of the skills development levies act and section 12 of the unemployment insurance fund act doesn't offer any. Penalty waivers are usually limited to periods originally filed in a timely manner. A request can be sent for: Tax penalty waiver online form business tax refund request for business tax. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty).

To request a waiver, you should do the following When their chances of getting the extra penalties and interest waived is slim, people often wonder what they should do if they cannot pay the total amount in one payment. Taxpayer's name (legal name if business) part 2. A request can be sent for: The minister may grant relief from penalty or interest when the following types of situations prevent a taxpayer from meeting. Interest is a compounded daily interest with a if you have to file late or if you have already filed late in a previous years, you can request to have both your interest and penalties waived. If you have been charged a penalty but believe you have reasonable cause (e.g. Waiver requests for late reports and payments. For {number} years i have made monthly payments on this debt, without exception. All other requests now being assigned to an officer were received in december 2019. Reasonable cause may exist when you show that you used ordinary business care and prudence and. I am writing to request that you waive the penalty of {amount} on account number {number}. I have savings account no.

You need to tell us the reason for your late filing, non electronic filing or late payment. Tax penalty waiver online form business tax refund request for business tax. Automatically waiving the estimated tax penalty for eligible individual taxpayers who had already filed their 2018 federal income tax returns. Penalty waivers are usually limited to periods originally filed in a timely manner. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed.

I am writing to request that you waive the penalty of {amount} on account number {number}. Interest is a compounded daily interest with a if you have to file late or if you have already filed late in a previous years, you can request to have both your interest and penalties waived. It's true that i paid {number} days late, but there were extenuating circumstances. The minister may grant relief from penalty or interest when the following types of situations prevent a taxpayer from meeting. Request for transcript of tax return. Apply to waive a penalty and let us know why you paid or filed your return late. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed. A request can be sent for: List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. We encourage taxpayers to provide any documentation supporting their waiver request. To request a waiver, you should do the following Waiver of late tax payment / filing penalty. The irs recently announced it would waive the penalty for any taxpayer who paid at least 80% of their total federal tax obligation during the year.

Request To Waive Penalty! Waiver of penalty letter example.

Referencia: Request To Waive Penalty

EmoticonEmoticon